F U Money for Developers

Wish you had the confidence to quit tech, go live in the woods, and play D&D all day?

You might be closer than you think.

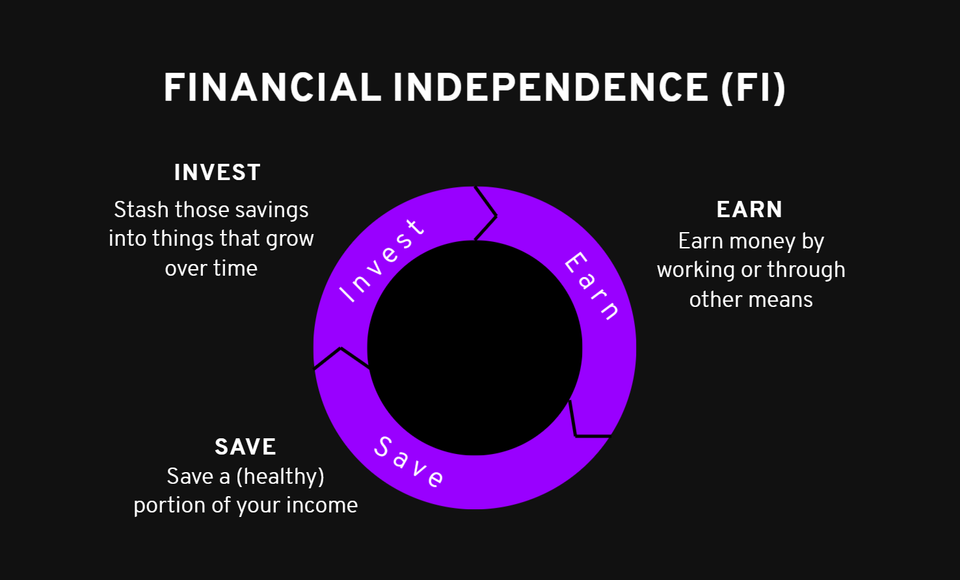

ESI stands for “earn, save, and invest” and it is the main loop that powers your wealth-building game. By turning the dials of ESI up or down, you can build a perpetual money-making machine. Learn how giving yourself a raise, geoarbitrage, house hacking, 401k automation, pay-yourself-first, and other financial design patterns help you automate your wealth building and reach financial independence faster.

This is not an abstract talk, it’s a personal finance story.

As the son of an immigrant, nobody taught me how to build wealth but as a Fortune 500 software developer I had the privilege of not needing to think about money… until I had kids. Paying 2X for daycare was a suckerpunch to the gut and that’s when I stumbled across the FIRE crowd. Sacrificing everything to retire early didn’t appeal to me but slowing down and enjoying the journey did.

Even with a house, wife and three kids, applying the ESI framework took our 14% savings rate to over 50% after 2 years which let us take summers off, slow travel, and gave me the confidence to work for myself.

I definitely play more D&D now but I don’t live in the woods.

Yet.

Watch the 50-Minute Talk

Listen to the 12-Minute Summary

Don't have 50 minutes? Listen to the audio summary from NotebookLM.

What People Say 💖

Collected in session feedback. Yes, it's all of it.

Amazing and informative talk! Thank you for sharing your experience!

Financial Independence is the most important topic of this conference in my opinion. Great information for any person with life changing benefits if you look at it seriously. I'm very glad to see this was the path the speaker ended up on and hopefully this talk has helped to spread the word to others as well. Great personal story!

Excellent presentation and storytelling!

Excellent talk!

Fun, inspiring, and entertaining!

Great combo of personal finance and a touch of programming thrown in!

Great life skill presentation. Loved having a non-tech topic.

More of this!

Polished content, great slides.

Very good public speaker! A good topic that a bit of devs don't know, even though it's not a strictly technical talk.

Very prepared & polished - good story-based presentation.

Well-presented, practiced, engaging and good info.

Some good advice, some not as relevant. Interesting trade-offs. Great slides and well-prepared presentation.

Events

Free Resources

Looking for all the patterns, links, and resources from the talk? I've created a 58-page PDF of everything I mentioned and more below.

Here is the list of what's covered in the downloadable PDF, in order of appearance:

- Self-Employment

- Work-Study

- Student Loans (Anti-Pattern)

- Pay-Yourself-First (Reverse Budgeting)

- 401k Automatic Contribution Increases

- 401k Company Matching

- Renting

- Geoarbitrage

- Sabbatical

- Forbearance (Anti-Pattern)

- 401k Loans (Anti-Pattern)

- Job Hopping

- Flexible Work Arrangements (FWAs)

- Home Ownership (Possible Anti-Pattern)

- House Hacking

- Roth Emergency Fund

- 4% Rule / Safe Withdrawal Rate

- Savings Rate

- Budgeting

- Bi-Weekly Mortgage Payments

- Refinancing Mortgage (Possible Anti-Pattern)

- Snowball and Avalanche Debt Repayment

- Summers Off

- Daycare FSA

- Travel Rewards Cards

- Meal Planning

- Bill Optimization

- Monthly Fee of 173

- Opportunity Cost

- Index Investing

- Passive Income

- Dividend Investing (Dividend Kings)

- Automatic Investments

- Triple Tax Advantage of HSAs

- 457B Early Withdrawal

- Lifestyle design

- Shield of F U Money

Some of these links are affiliate links and at no additional cost to you, I may receive commissions if you purchase through them.

Download the ESI Patterns

This PDF contains the topics below, a pared-down version of the full slide deck.

Podcasts

There are many personal finance podcasts to choose from, but these are the ones I listen to.

- ChooseFI

- Journey to Launch

- Afford Anything

- His and Her Money

- Stacking Benjamins

- Bigger Pockets

- Everyday Courage

- Rebel Entrepreneur

Check out Financial Podcasts Hosted or Co-hosted by Women and the Top 5 Black-Owned Podcasts as well!

YouTube Channels

Blogs

These are some of the highest-impact blogs I've read.

- Mr. Money Mustache

- Frugalwoods

- Early Retirement Now

- ESI Money

- Physician On Fire

- White Coat Investor

- The Fioneers

- A Purple Life

Finance Books

I've read these books, and I'd recommend them if you're interested in diving deeper into personal finance.

- The Simple Path to Wealth by JL Collins

- Your Money or Your Life by Vicki Robins

- The Little Book of Common Sense Investing by Jack Bogle

- Work Optional by Tanja Hester

- A Random Walk Down Wall Street by Burton Malkiel

- The Millionaire Next Door by Thomas J. Stanley

- ChooseFI: Your Blueprint to Financial Independence

Lifestyle, Productivity, Self-Development Books

Separate from finance but equally important, these books helped change some of my mindset around getting things done and figuring out what's important to me.

- Atomic Habits by James Clear

- Make Time by Jake Knapp and John Zeratsky

- Essentialism by Greg McKeown

- Company of One by Paul Jarvis

- Designing Your Life by Bill Burnett and Dave Evans

- The Last Safe Investment by Bryan Franklin and Michael Ellsburg

Articles

These are articles I reference during the talk, many of them are commonly cited in the financial independence community.

- Shockingly Simple Math Behind Early Retirement

- JL Collins: Stock Series

- Safe Withdrawal Rate Series

- HSA: The Ultimate Retirement Account

- Donor Advised Funds: The Smarter Way to Give

- Socially Responsible Investing

- 7 Reasons to Love Your 457

- Domestic Geoarbitrage (and international)

- 9 States with No Income Tax

- Sabbaticals (Adobe Handbook)

- Can you use a Roth to buy a home?

Tools

- Monarch Money (replaces Mint)

- Reach FI (my tool)

- Complete Tax Planning Bundle (I use this for planning)

- Networthify Early Retirement Calculator

- Cash Flow Workbook

- Financial Toolbelt

- FI Laboratory

- On Trajectory

- Projection Lab

- TillerHQ