New Tax Season DLC was released! Time for an SOP.

No, I wish I were talking about a new season of Diablo IV but alas... it's tax season (rabbit season, TAX season, RABBIT season, TAX SEASON).

I use a CPA and I highly recommend you get one too if your taxes are not so easy anymore. It used to be okay when it was just me and Cassie for years working salaried jobs but now I have 3 kids, a mortgage, vehicles, an LLC, multiple retirement accounts spread around, and a whole lot else.

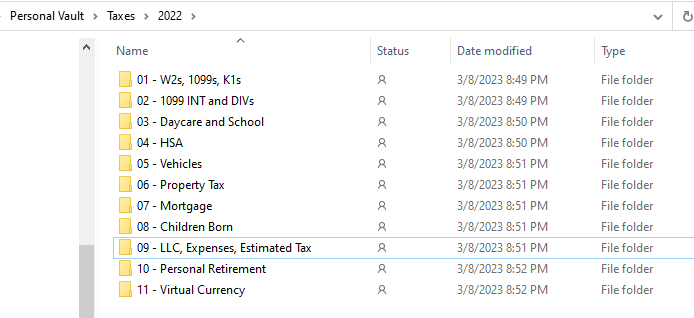

Now the CPA just sends me an envelope with a checklist and I organize all my stuff digitally:

There's still the dance I need to do to find everything and this is where having a personal Standard Operating Procedure (lovingly called an SOP) is handy. Now – I don't have one – BUT IF I DID, I would tell you that it outsources your brain to a checklist.

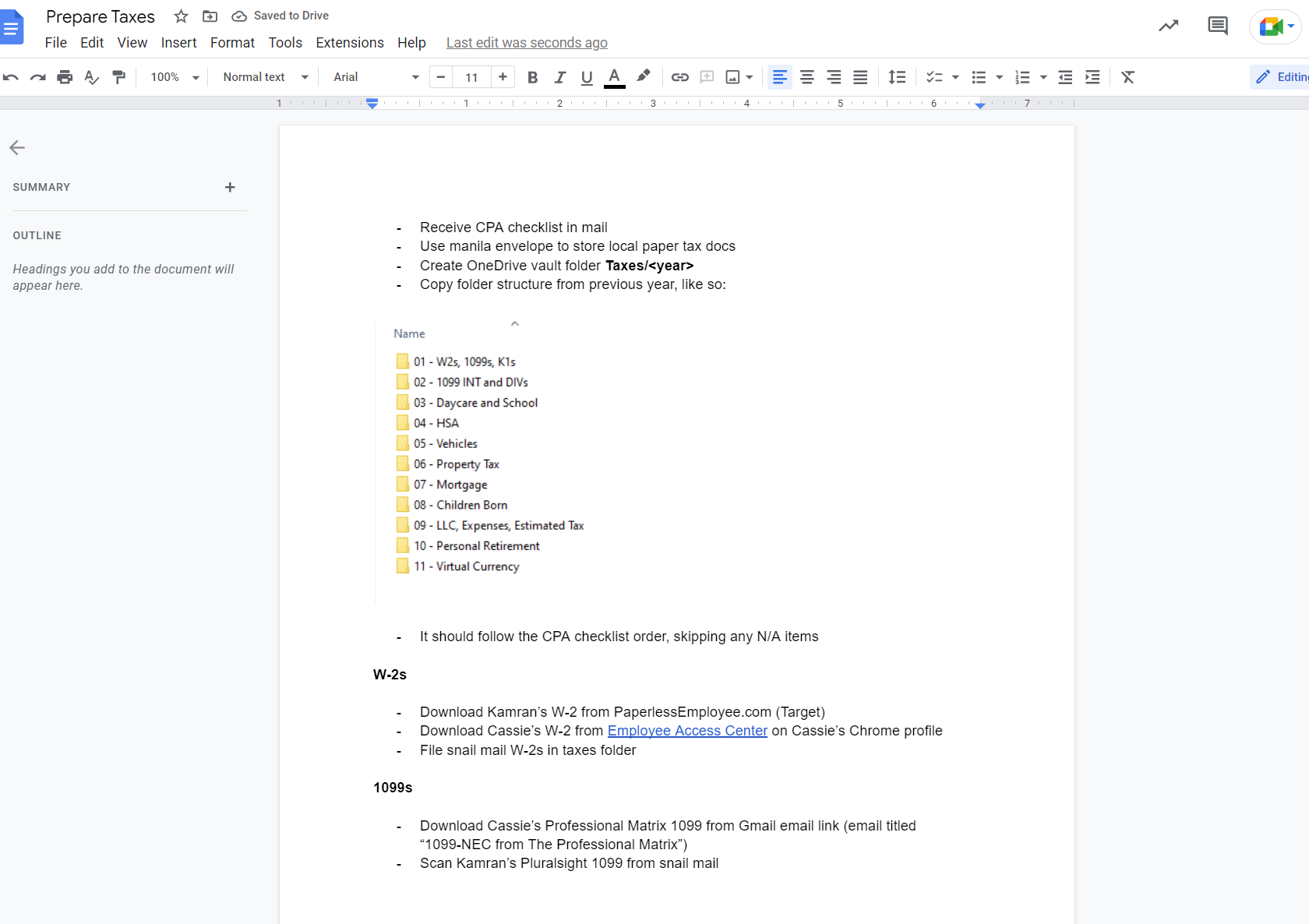

In fact, now that I said that, I'm going to go and make a Google Doc right now to do it. BRB.

OK, back.

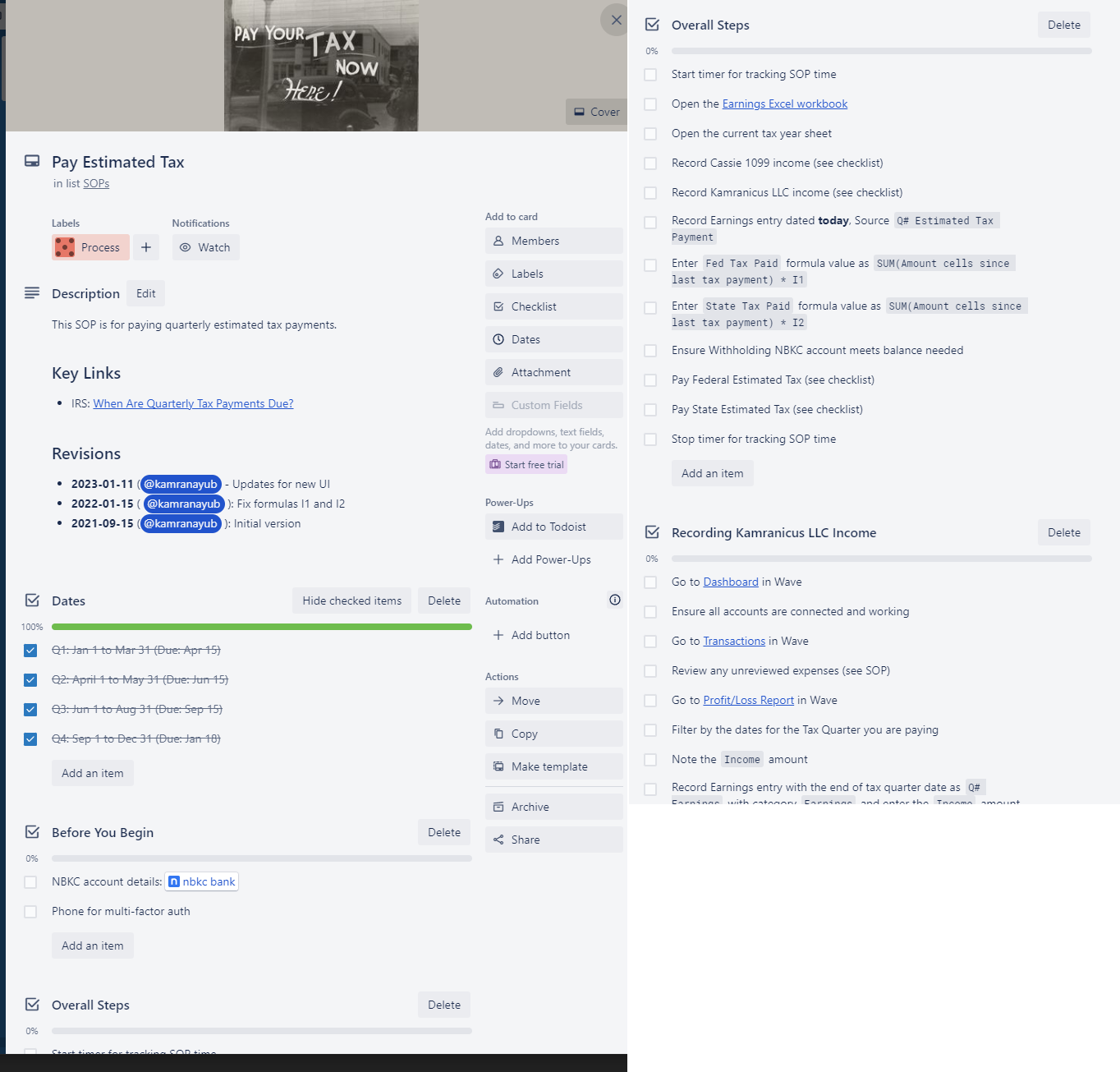

Here's a screenshot of an SOP I have for my LLC to do estimated taxes, just to show you what a full one looks like:

So what's neat about SOPs is that they are a) living documents but b) once you keep using them, they get more and more rote and easy to follow.

I took Jonathan Stark's 10 Day Systems Challenge in January and I even made an SOP for our weekly meel planning. I installed aText expander and now have a shortcut where if I type $sop or hit Alt + Shift + S it'll open my SOPs folder.

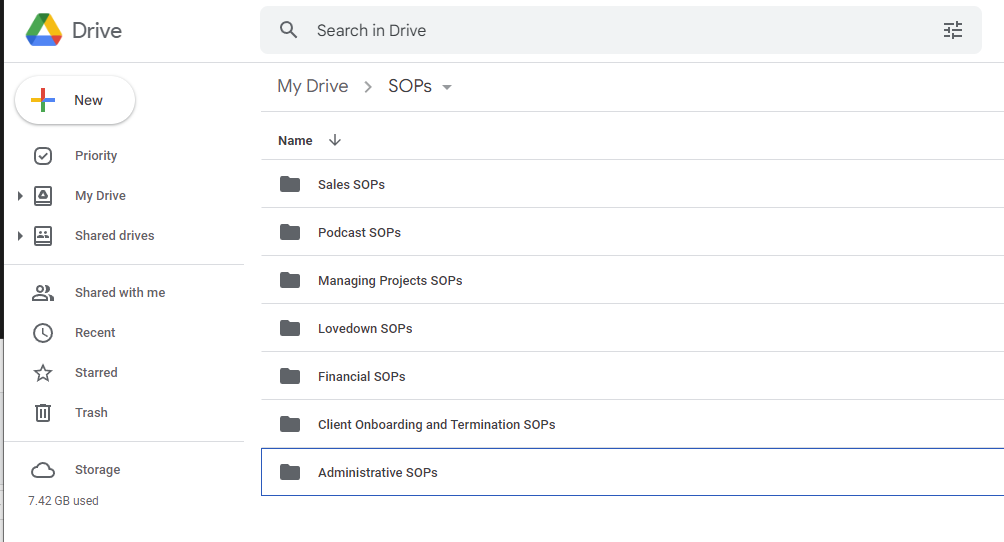

In solopreneur life, SOPs are amazing and I have ones for multiple workflows and processes now:

If you are used to admin assistants in corporate life sending you TODO lists and your business has a lot of process documents and such, then you are probably benefiting from SOPs other people made – but when you work for yourself, you only have yourself to rely on to get organized. You could hire a Virtual Assistant (VA) as I know some folks do but probably not out of the gate.

BUT ANYWHOO. TAXES.

Doing taxes would benefit from creating an SOP, is all I'm really trying to say.

There's a thousand accounts to log into, some you own, some your partner may own, some your kids may own. Your CPA isn't going to go through and do all that for you. Websites change all the time.

What I typically do right now is go to the previous tax year and double check I got everything I had before but of course this doesn't catch new things.

But now because I sat down to write this post, I now have an SOP I can fill out as I finish this year's taxes out.

What about you, do you have a SOP you follow? Care to share?

Cheers,

Kamran