Monarch Money 3-Month Review

One of the things I like about using personal finance apps is the insight you get into your spending. What gets measured gets improved, so if you need to improve your finances you best start gathering data.

You've maybe heard me mention using Mint in the past – but Mint is dead. There are a number of alternatives and the smart ones have new marketing landing pages that break down how they compare.

I can save you the trouble and tell you that I've been happily paying for Monarch Money since November (that's my referral code!).

Use MINT50 to get 50% off your first year

Monarch made it easy to transfer over my account, including a custom open source browser extension that would vacuum up all my transaction history to import.

Here are some other things I love about Monarch:

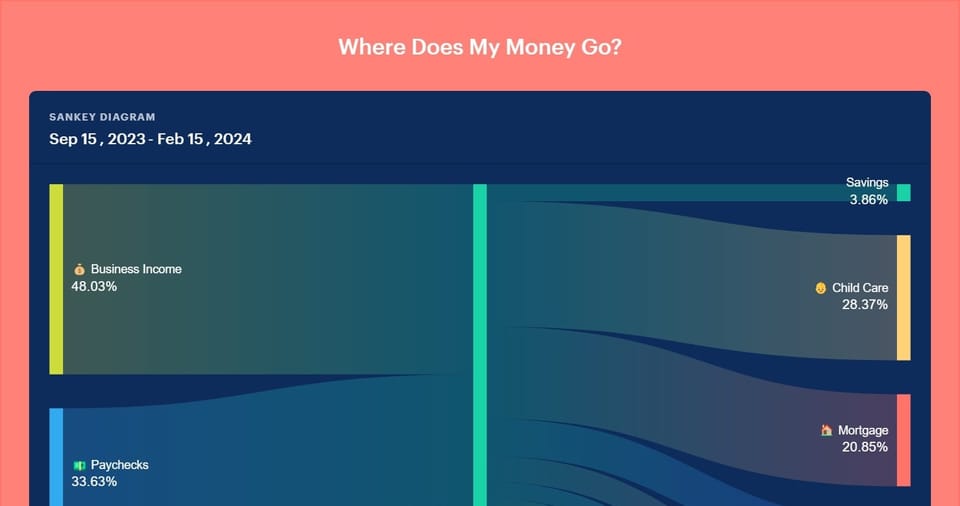

Quick progress check-ins. Anytime you open the app, it provides a calendar at the top where it highlights the days since you last reviewed your finances. You tap "Start Review" and it walks through your key vitals step by step – cash in/out, net worth increase, debt breakdown, etc. It makes checking in much easier. This is not a feature in the web-based app, I've only seen it in the mobile app but that makes sense – on my phone, I'm mostly interested in quick check-ins but the app is also fully-featured.

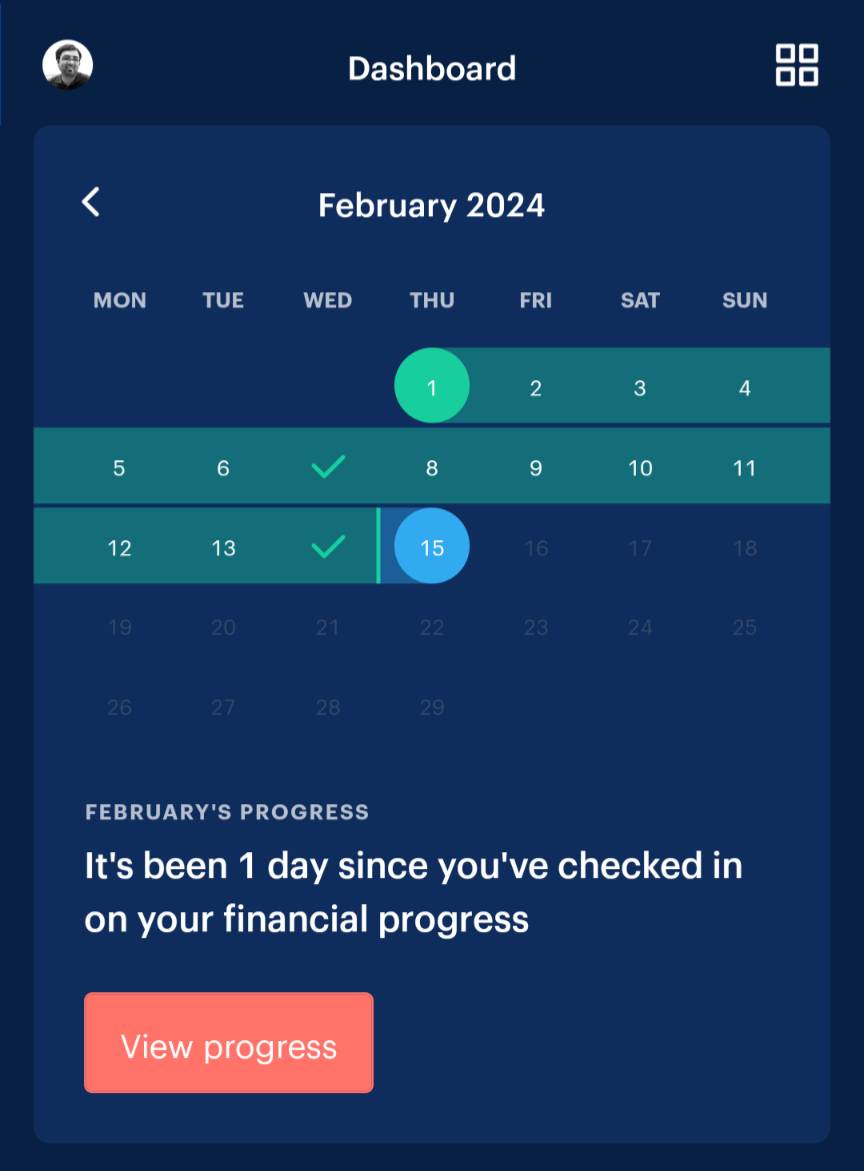

Kids are expensive...

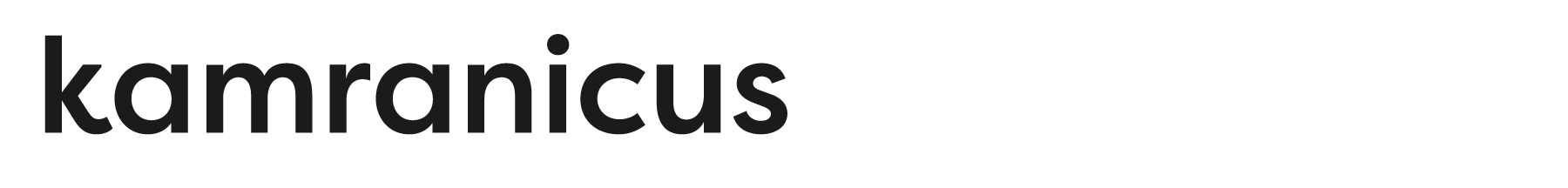

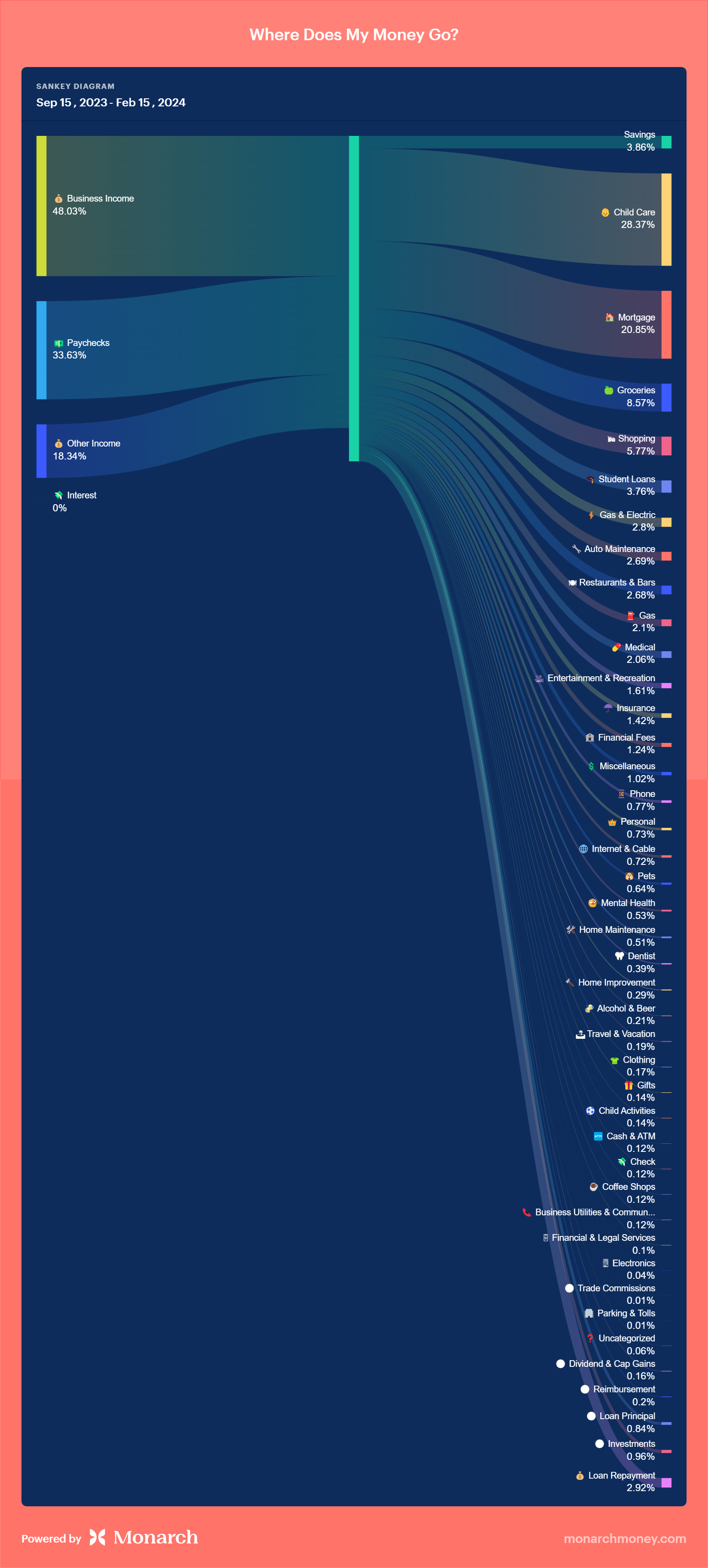

Lots of reports. As featured above, Monarch is continually adding new ways to visualize and get insights into your spending. The Sankey diagram is awesome and for most visualizations, you can share them without numbers (so you can see how kids are more expensive than our house).

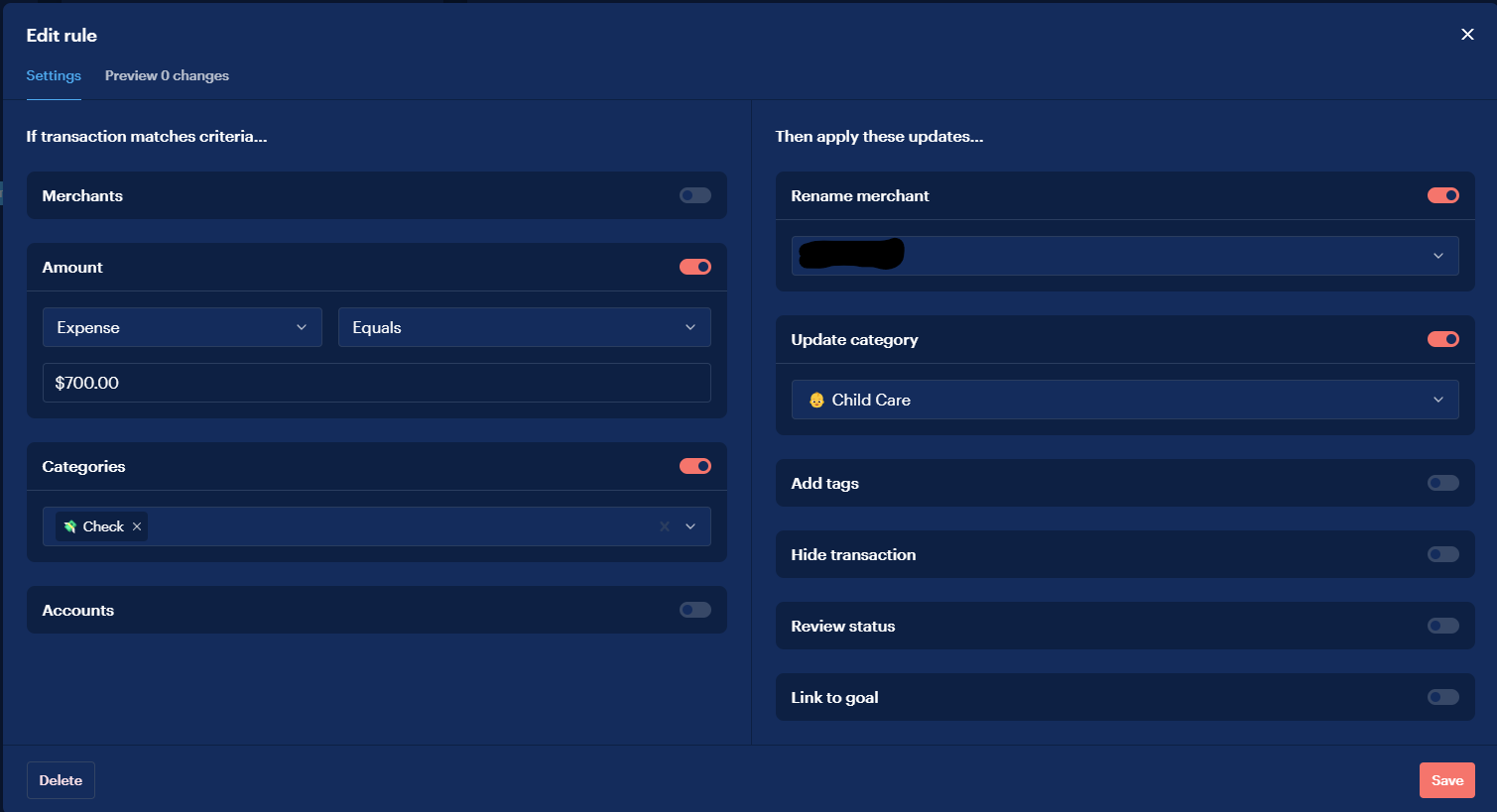

Advanced rule engine. Mint had custom categories but Monarch goes a step farther, allowing you to dynamically match transactions. It was always annoying in Mint how I always had to manually categorize daycare expenses because it just says "CHECK" yet the amounts always were the same. With Monarch, I set up a rule to do it 🎉

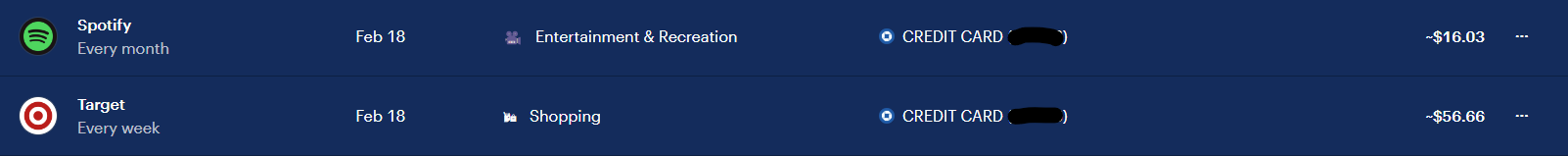

Better recurring detection. Mint could do some recurring detection but Monarch is loads better. It will use "estimated" amounts and you can always edit or remove the ones it detects. But it'll learn over time. You can view everything in a calendar view or list.

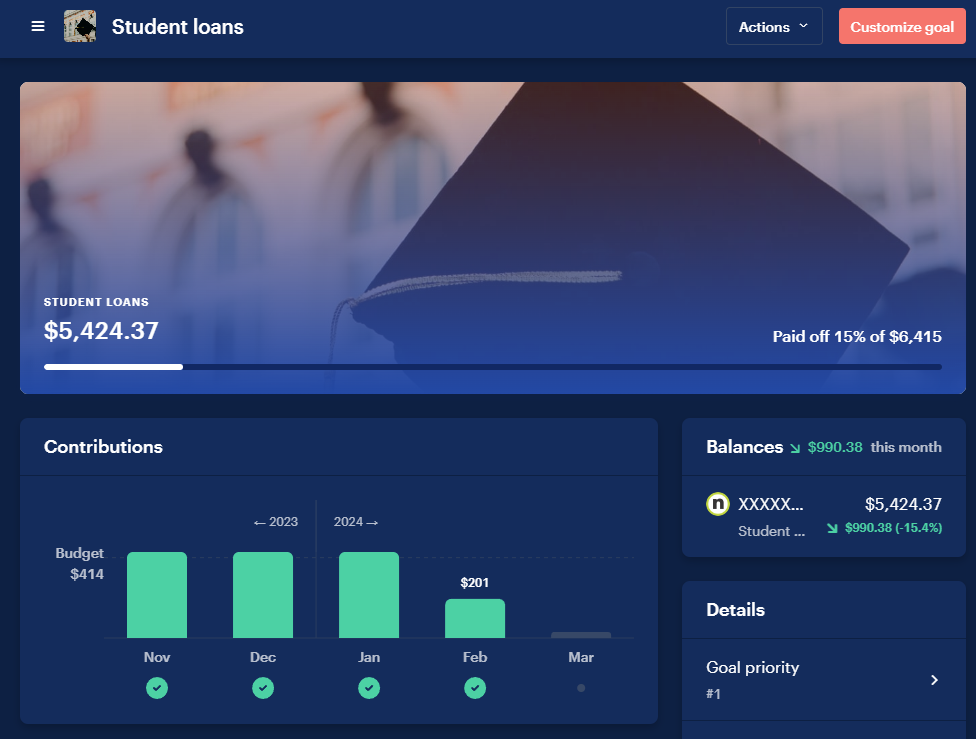

Flexible goals. I always hated how in Mint you basically could only set a goal to reduce credit card debt so they could sell you cards. In Monarch, you can make a goal for anything. Take a summer off. Buy materials for the shedquarters. Whatever you want, and you can assign more advanced rules for the accounts or transactions it uses.

Share with your partner. For Mint, my wife never really used it on her phone and I had to use my login for her. With Monarch, she has her own login and can get customized alerts/reports. Household sharing is just built in because... that's how you manage finances. Financial advisors can even be invited separately (with fewer permissions).

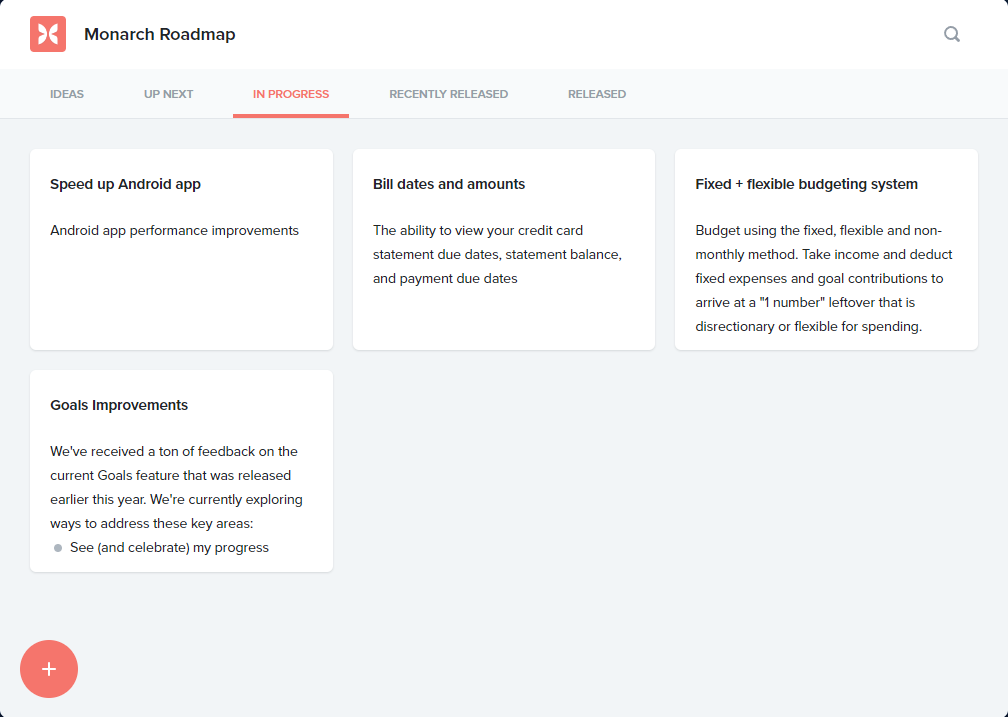

Public roadmap. The Monarch team is pretty transparent in what's coming and you can see the work as it progresses. This is a great way to have your say in what gets built.

Support that cares. Unlike Mint, with Monarch I can contact support and they'll actually pay attention. Over the past couple of months, they've been inundated with 20-30X the amount of support due to the Great Mint Migration and they STILL replied to me pretty quickly despite all that.

It isn't perfect but it's close enough

Compared to Mint, the experience has been much better. It's not 100% perfect though.

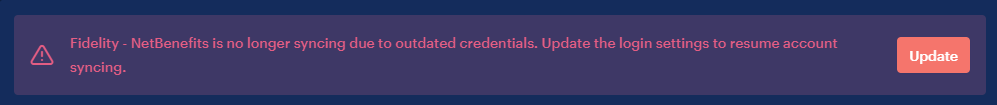

Accounts that don't sync. I've had issues syncing a couple of accounts like my wife's 457b. However, I've made do by having the apps on my phone and occasionally updating the balances in Monarch when I do my reviews. Other accounts will work if I manually go through the auth flow once a month.

In addition, I got my Optum Bank HSA working as well. Now we only have one account (Empower/MNDCP) that we have to manually update.

Can't customize savings rate. In the financial independence space, there's varying calculations for savings rate that can include investments or mortgage principle payments. Monarch calculates a savings rate, but it's cash only and doesn't incorporate some other measures like I had done with my own little Reach FI app.

No financial modeling. This is not a feature I'd really expect with Monarch but it would be nice. Personal Capital (now Empower) has a great retirement calculator and a way to simulate different future scenarios based on your net worth and history. For now, you'll just need two different tools and that's probably fair. Monarch is focused on the here and now, not the future. They are adding more and more investment-related features though like transaction importing.

If I've convinced you to try it out, here's my referral link again and I think you can even still use the MINT50 promo code to get your 50% off.