Mini Case Study: Tapping Your F U Money

Building up F U money was a critical component that gave me the confidence to quit and become a solopreneur. In the worst case, we had a financial life vest that could help us float for a few years, even with zero income.

However, it's one thing to build it and another thing to tap it – but that's exactly what I did at the beginning of 2024, and I want to walk you through the thought process and the mechanics of taking money out of your nest egg.

Drawing Down Early

In financial independence speak, this is called "drawing down" from your investments. It's something you're only "supposed to" start doing when you're ready to retire and live off those investments.

I say "supposed to" because a situation may arise when it can make sense to withdraw early from investments.

It's important to understand that different accounts offer different tax consequences for withdrawing, with traditional retirement accounts having the most strict tax consequences.

In general...

- Roth IRA contributions can be withdrawn with no taxes or penalties at any time. Earnings are subject to early withdrawal rules and penalties.

- Taxable brokerage contributions and earnings can be withdrawn at any time, but the capital gains will be taxed.

- Traditional retirement accounts (401k/403b/457b) cannot be withdrawn from at any time before age 59 1/2 with the exception of specific rules.

- HSAs can be reimbursed for medical expenses at any time but turn into traditional retirement accounts after age 59 1/2

I have withdrawn early from our Roth IRAs previously, one time to cover the downpayment of our house (which is an exception to the earnings penalty rule) and to cover some cash flow in 2023 when client work slowed down. However, withdrawing from a Roth IRA is pretty straightforward because as long as you stay below your contribution amount, it's as simple as a bank transfer (which is why I love them for holding emergency funds).

Where it gets interesting is drawing down from taxable brokerage accounts because these are often held up as a good "bridge account" from early retirement to traditional retirement – in other words, you tap them first before anything else.

The first question to answer is: how much can you safely withdraw without losing money?

That introduces one of the foundational concepts of FI, the 4% rule.

The 4% Rule of Thumb

In general, you can safely withdraw 4% of your total investment – also called the 4% rule of thumb. If you inverse 4% you get 25, which is why you'll often hear that to calculate your financial independence number, multiply how much your life costs by 25. So if your life costs $60,000/yr, your financial independence number is $1.5 million. This is how much you'll need to have invested to stop working and live off of forever – according to the 4% rule. Shockingly simple.

In practice, though, many folks prefer to be a bit more conservative and target 3.5% or even 3%. Inversing those gives you 28X and 33X your expenses as your FI number. The nuance depends on the sequence of returns risk. Withdrawing less helps mitigate the risk that you'll withdraw during a down market multiple years in a row. Conversely, if you retire in a bull market, you could safely withdraw more. It's not a fixed rate and depends on your situation.

When You Can Withdraw

Typically, you begin drawdown when you reach your FI number – which could be any age, depending on your savings rate and the math.

However, the 4% rule also assumes you don't plan to replenish your investments (or earn any income!) during drawdown. That is very unlikely when you're still mid-career or are self-employed.

What this means is that you can technically apply the 4% rule anytime—like before you hit your actual FI number. It's not ideal because you rob yourself of future compounding, but it is a viable option sometimes. Based on our specific circumstances at the beginning of the year, we chose to do this.

In December 2023, my whale client was leaving – leaving me with no consulting income to rely on for January and possibly February.

For someone who has no F U Money, this is a hair-on-fire situation – and it's what many people imagine will happen if they quit to work for themselves.

What happens if I lose all my clients?

What happens if my SaaS fails?

What happens if nobody buys my info products?

The Fear will keep you from taking the leap and lock you into poor-fit situations that burn you out.

That's why building up F U Money before you quit is so empowering – it turns a potential emergency into an inconvenience. It builds confidence to overcome those fears because it turns a one-way door decision into a two-way door decision. You can always back out and fall back on your F U Money.

Getting Past the Fear of Withdrawal

We decided to withdraw from our taxable brokerage account to close the gap in cash flow from losing client income to covering our expenses for 1-2 months as I looked for new opportunities.

As I said, this is not an ideal scenario – withdrawing from a brokerage account has tax consequences. But since we had already withdrawn from my Roth IRA in 2023, I didn't want to deplete that further to give it a chance to refill (which it has, btw!). That left our brokerage account.

I'd be lying if I said this was an easy decision. After all, I'd rather leave the money be and let it grow, that's the whole point. Taking it out loses future growth. But at the same time, why are we doing this? To be able to take more risks than would otherwise be comfortable. To achieve a level of time freedom I didn't have before working full-time. If I didn't take it out, I'd need to return to a job, and I didn't like that idea. A 40-hour/week job would mean some substantial lifestyle changes.

There's a book that keeps getting recommended, Die with Zero, and I haven't got around to reading it yet – but that's the gist. It reframes your relationship with money. If we're going to the trouble of saving all this up, we also need to be comfortable spending it freely when it counts – and this was a time that counted.

Once decided, it was time to perform the withdrawal which I had never done before – and it was important to understand the tax consequences of doing so.

What I learned was that withdrawing from a taxable brokerage was way less impactful than I initially thought due to a concept called your effective tax rate.

How Capital Gains Taxes Work

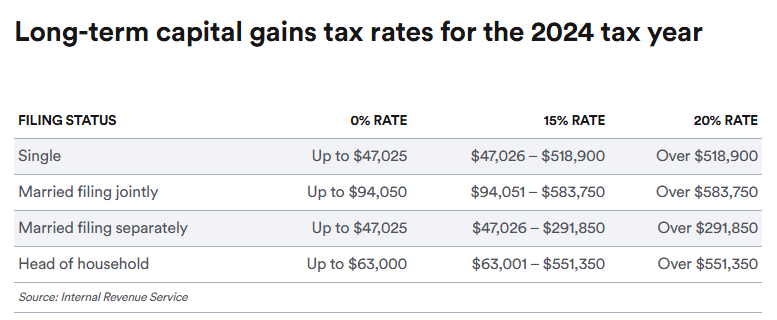

You are taxed on the capital gains – the money that accumulates on top of the initial investment while it is invested. This is divided into short- and long-term capital gains, taxed at different rates. Short-term gains are investments that less than a year old. Long-term is more than a year. The tax rate on LTCG is very favorable with three buckets: 0%, 15%, and 20%.

You might initially think what I thought: that the total amount you withdraw is taxed at whatever fixed rate. But that isn't the case.

The nuance here is that not all the money you withdraw has gains. When I withdrew, I specifically chose investments that had losses or very minimal gains so that there was an effective tax rate of 0% on the withdrawal.

Say that again for those in the back, please.

When you invest in the stock market (index funds in our case) you deposit a chunk of money from your bank account – let's say $1000 – and then you buy shares at whatever price point the ETF or mutual fund is priced at. So on day one, you buy $1000 worth of shares of an index fund.

The promise of index funds is that over long time horizons, this money will compound due to the share price rising with the market (because the market always goes up). The average is 8-12% per year. In some years, it will be less, and in others, more. During COVID, for example, stocks went down a bit, then bounced back up.

Let's keep it simple and say you don't buy another share, and 3 years later your investment grows to $3000 due to the market rising. If you withdraw all the funds, you are looking at a capital gain of $2,000 ($1,000 initial + $2,000 gain) on that initial share buy transaction. Since these gains are over a year old, you will be taxed at a lower rate.

In the context of taxable brokerage, where you put in after-tax money, this means you are taxed like so:

- $1,000 remains untaxed (what you initially put in was already taxed)

- $2,000 x LTCG rate

The LTCG rate varies depending on your situation:

We are MFJ and were at the 15% rate in 2024. That means the $2,000 would be taxed at 15%:

- $2,000 x 15% = $300

So, to withdraw all $3,000 of your invested funds, you paid an effective tax rate of 10%.

Controlling Your Capital Gains

How do you specifically withdraw investment contributions that have little to no gains?

When you set up your investment account, you can tell your provider to track your investment's cost basis using the "specification identification" (SpecID) method. Essentially, think of this as assigning a unique ID to every transaction. That means when you withdraw, the provider can list all the buy transactions, their initial cost basis (what you paid originally), and how much gain or loss they had over time.

All I did then was selectively pick transactions that, when added up, resulted in close to a 0% gain. For example:

- Jun 10, 2018: $400 basis + 2% gain

- Nov 6, 2021: $400 basis - 2% loss

These two transactions would net out to 0% gain. Since I'm using Vanguard, it just shows me the total calculated cap gain so I can pick and choose as appropriate. I tried not to pick large cost-basis purchases (because that money will tend to gain/lose more), but since many of our automatic investments were $100-200 at a time over the last few years, I could pick smaller transactions.

There's a limit to this approach because the hope is that you gain a lot over time, but it was enough to be well under our 4% safe withdrawal rate and to cover us for 1-2 months.

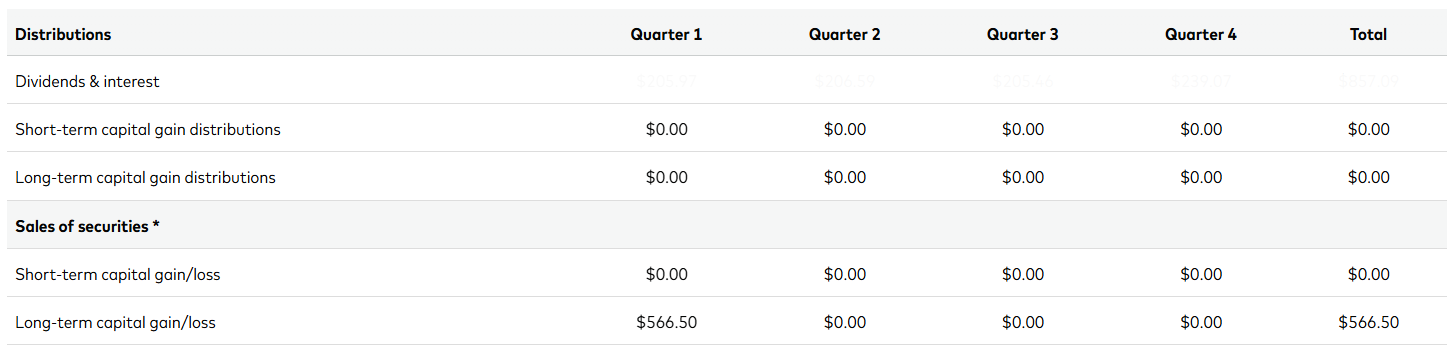

At the end of the year, your brokerage provider will give you a year-end tax statement showing the IRS the capital gain/loss withdrawn so you can be taxed appropriately.

Here's an example of Vanguard's year-end tax report showing the capital gains due to stock sale proceeds:

So my effective tax will be $85, which is essentially peanuts – and yet we were able to withdraw enough to cover 1-2 months.

If you want a deep dive into how this works or are still confused with the jargon, I highly recommend listening to ChooseFI:

How It Shook Out

That withdrawal enabled me to pursue full-time course authorship with Pluralsight, which led me to surpass my 2023 business income (which replaced all my consulting income!) and, hopefully, put me on track to double my revenue in 2025. It also enabled me to keep spending time building KTOMG, which just recently surpassed $100 in monthly revenue in December.

That is the power of F U money.

But did you end up losing money?

Since the amount we took out was more like 1-2% of our total asset allocation, it was well below the 4% rule.

The market returned nearly +23% in 2024, so the balance of our brokerage account dipped in January 2024 and has now risen to exceed what it was previously.

We still lost out on the future growth of that money, but it is still a net positive a year later. That may not be in our control, but it's a great outcome, and it helps mitigate some sequence of returns risk.

Since we've kept saving and investing throughout the year, our net worth is higher and we are that much closer to achieving our FI number.