How splitting my paycheck gave us $10k for our sabbatical

Early in my career I was talking with a friend and he mentioned the way he divides his paycheck is by depositing a fixed amount in his checking and sending the rest to savings.

...what?

I was floored. I had no fucking clue you could split your paycheck.

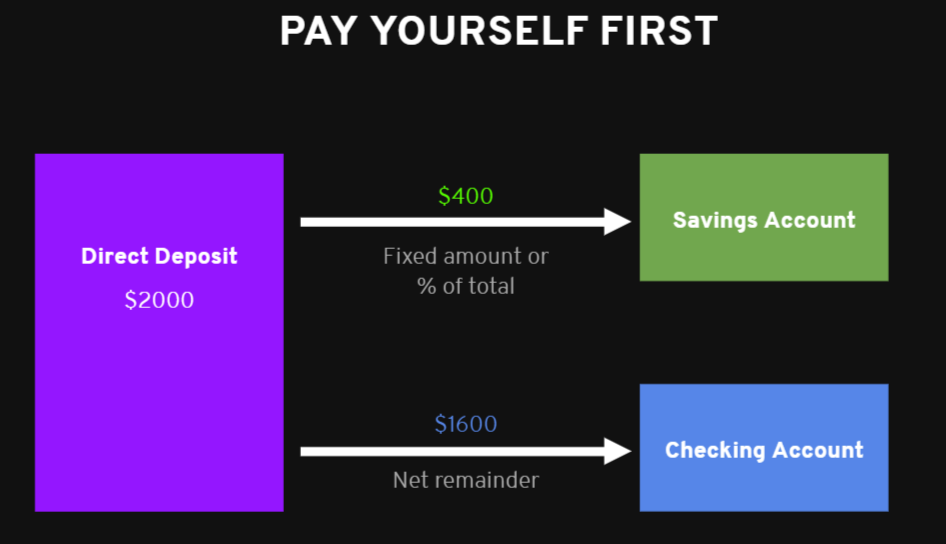

It wasn't until recently I learned this "financial design pattern" is called pay-yourself-first.

Pay-yourself-first is a great pattern to lean on when you hate budgeting (that's why sometimes people call it the "reverse budget.") Until you become more comfortable breaking down your monthly spending and expenses, this is a set-it-and-mostly-forget-it method to saving.

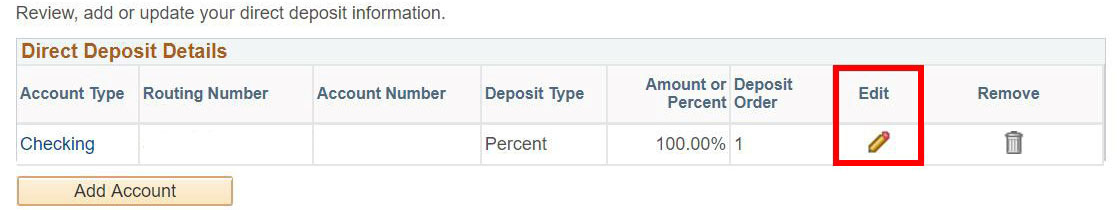

This does require direct deposit. If your company uses software this should only take a minute or two to set up (okay, 10 minutes in SAP 😅).

If you're like my wife, you may need to send in a paper form to your benefits department.

I started doing this around 2012, two years into my career. I was already contributing 7% through my 401k by then. This helped us boost savings by another 1-2%.

Grew to $10k by 2015

By stashing that away in our savings account, it grew to $10k by 2015. That's when we were making plans for me to work remotely in France and Europe for a year. Instead, that turned into a 6 month sabbatical.

Without that $10k, it would have been WAY harder to make it work and we probably would have had to shorten it to 3 months.

So thanks Erik!

I'll be sharing more of these design patterns for your financial life at the Minnesota Developer Conference on June 22. If you're in the Twin Cities, consider joining!

If you can't make it and don't want to wait for the recording you can also watch the 2021 version.