Doing the financial limbo

You know the limbo: that accepted form of torture "game" where you try to contort your body to go under the a horizontal bar a few feet (or less) off the ground...

The audience is chanting, "How low can you go?!" over and over again.

Saving money can be like doing the limbo... at some point, you are going to be forced to contort yourself in unnatural ways and you'll hate it. The voice in the back of your head might be chanting the same thing.

How low can you go?!

How low can you go?!

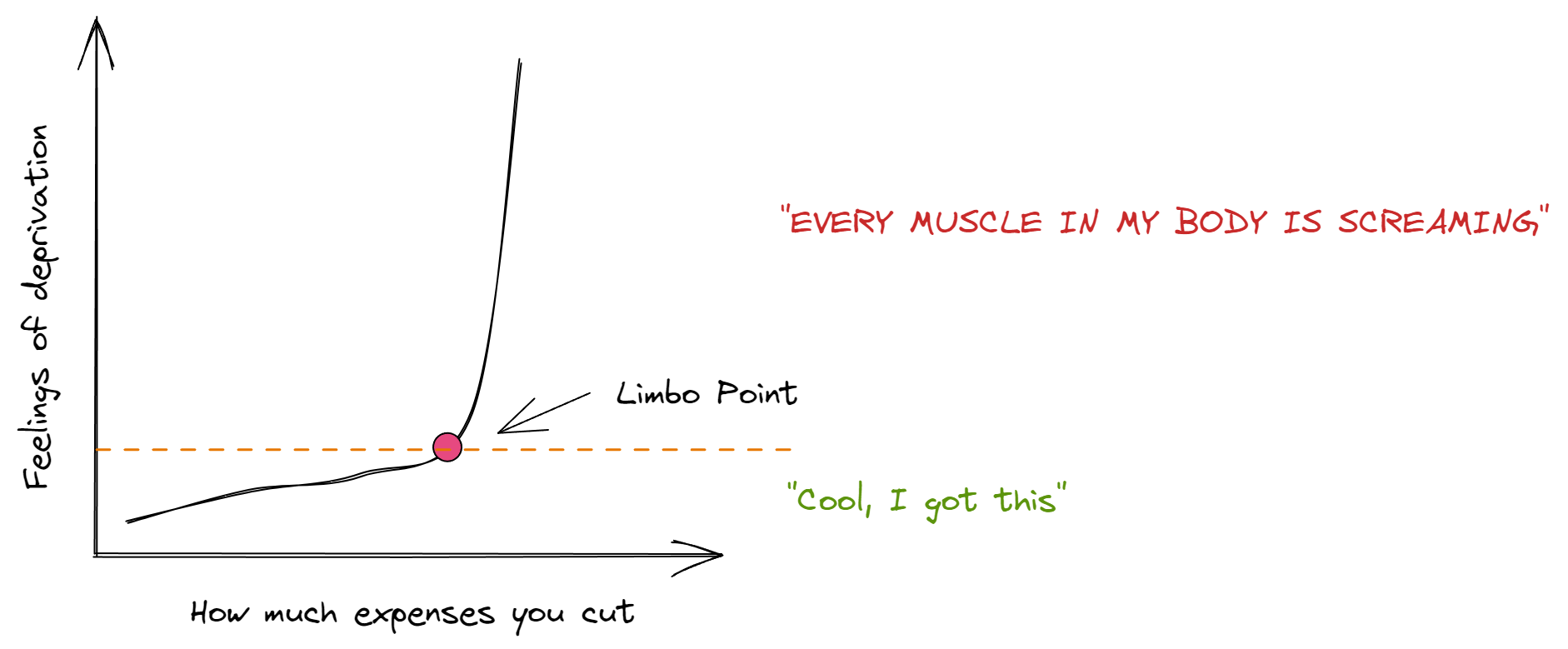

If I may be so bold, maybe this can be called The Limbo Point as drawn on this handy dandy graph:

On the Y-axis you have "feelings of deprivation" and the X-axis is "how much expenses you cut." As you cut more and more expenses, you will eventually reach a point where you begin to feel like you're making a sacrifice.

Your Limbo Point.

Each person has their own Limbo Point. And that point can change throughout life's seasons.

Since I have kids that go to daycare and a mortgage, my limbo point is lower than it was back when we didn't have kids and lived in an apartment.

So what's the point (🥁)? Know your limbo point! And know it isn't fixed, it's variable.

If you want to move your limbo point, you could:

- Adjust your mindset

- Adjust your expenses

- Adjust your income

Now you can ask yourself questions like:

- How many expenses can you cut until you start to "feel it"?

- Have you ever tried going past your limbo point?

- If you don't like where your limbo point is at, could you earn more to raise it?

Heck, you could actually chart it if you want!