Why I Bought An Old Ass MacBook

This week my MacBook Pro 2011 SSD drive died, and it can't be restored using the built-in Disk Utilities (spent a couple hours trying). My options were to...

- Buy a new SSD and reinstall everything (which requires using workarounds for Sonoma)

- Buy a new (to me) MacBook Pro

Option 1 would certainly save me money but I already did that initially. I got the Macbook for free initially from a friend. I bought new RAM + an SSD, and installed Sonoma using OpenCore Legacy Patcher. It worked but it was still painfully slow. Plus, you're living on the edge with an unsupported MacOS version.

I have been thinking about a new laptop for awhile to replace an old Lenovo Yoga. It fell on its face trying to spin up a local Docker environment.

I decided this was a good time to think about a new work laptop where I can do most of the things I do on my PC but on my laptop when I'm out and about.

Fast forward and I ended up purchasing a refurbished MacBook Pro M1 Max 14":

My new Old Glory

The first reaction you probably have is:

WHY?! Why not buy the latest M4?

It comes down to the way I make any kind of big purchasing decision and I wanted to share the process with you because it has saved me loads of money over the years.

Spending is a skill

Last year in 2023, Pete aka Mr. Money Mustache who was my gateway drug to learning about financial independence, was on the BiggerPockets podcast (highly recommend) and he said something very important:

Spending less money is not a deprivation, it is a skill.

In fact, it's literally the first thing he says.

I encourage you to listen because this is the essence of how to reach financial independence. It is not solely about earning more. Without a skill of spending, you can earn more and be no better off (or worse off) than someone who earns less but has a high skill of spending.

Examples:

- Instead of paying $200/mo for cell plan from Verizon, you pay $30/mo with Mint

- Instead of paying $44,000 with a car loan for a brand new minivan, you look at ConsumerReports and use Autolist to pay $18,000 in cash for a used one with 44,000 miles

- Instead of paying $750,000 for a new home in a nice area, you pay $305,000 for an older home in a nice area (with more square footage)

- Instead of paying $10,601 to install new HVAC using the contractor you've always used, you shop around save $1,000 by using a different one who ends up providing better service anyway

- Instead of paying $2,836 to visit Texas with a family of 5, you use travel rewards and pay $43.74

- Instead of paying $2,328 for a new MacBook Pro M4, you pay $1,350 for an M1 Max with 2.5X the amount of RAM and more GPU power

In case it's not obvious, these are actual numbers from the big purchase decisions I've made in the past few years.

The savings from these decisions alone are in the tens of thousands in the short-term, and hundreds of thousands in the long-term.

And was it a deprivation? Not at all. We fucking love our 2015 Honda Odyssey. My HVAC is boring and keeps us comfortable. We stay under the 2GB of data per month for our phones. We visited family in Texas and had a blast.

If this were D&D, I'd probably put Spending as a skill under Wisdom:

Wisdom reflects how attuned you are to the world around you and represents perceptiveness and intuition.

-- D&D 5e

Perhaps you could argue it falls under Intelligence – but I would say the skill is in the planning, which requires situational awareness.

Cool, now that we've established you need a skill of spending to achieve financial freedom, what does it mean exactly?

My process for big purchases

Let me share what I did today for my MacBook purchase because it's basically the same strategy I used for everything else.

Start with the End in Mind

A solid strategy for most things is to start with the end in mind.

In other words, work backwards.

There are probably thousands of options to choose from, so which ones are you going to narrow it down to? This is part of strategy – deciding what you're going to say No to.

- What do you even want? What are you going to do with it?

- What are you absolutely not going to compromise on?

- What are you willing to compromise on?

My answers here:

- I need a laptop for business work. I plan to do coding with .NET and Node.js, as well as video editing/recording. I would love to be able to write native iOS apps.

- At least 16GB of RAM and 1TB of storage (because I'll use it). I also want an NVMe hard drive. I want something durable and well-built to last a long time. Minimum 1080p resolution.

- I don't give a flying fuck about battery, audio, GPU, or the camera. I'm nearly always by an outlet, I use headphones, and I'm not playing games (and GPU cores on M chips are perfectly fine for video editing). I'd prefer a high screen resolution but it's not a dealbreaker.

This is an important part and skip it at your own peril – if you cannot get clear about what you want, you're not going to make an optimized purchase decision.

Also, be honest with yourself.

Do you really need 64GB of RAM or can you live with 16GB? This comes down to the details of how you use the thing or experience you're buying. Don't confuse 'wants' with 'needs.' I don't need more than 16GB but I do need more than 8GB based on my historical usage. Decide what's "nice-to-have" vs. "must-have."

Example 1

Need: I need first-class seats.

Why: I want more legroom. I want luxury. I hardly ever fly and I'm a solo traveler.

Compromise: I'll buy groceries and stay at a cheaper Airbnb instead of an expensive hotel and eating out everyday.

Example 2

Need: I need a new car.

Why: I'm worried a used one won't last that long.

Compromise: I'll buy a lightly used car that has less than 50,000 miles and buy an extended warranty for peace-of-mind.

There is no value judgement I'm making on you here – if you can find a compromise that saves you money somewhere else, and you get what you want, that's a win. The important part is that you're being intentional and have thought about the options.

Speaking of options...

Narrowing down the options

If you start with the criteria laid out previously, you now have a baseline search:

- 1TB of storage

- 16GB of RAM

- Durable and well-built

- Portable

- Native iOS app support

The obvious criteria here is supporting iOS development. If I want to make courses on .NET MAUI or port Excalibur games to iOS, I need a Mac. Since I need something portable, it's going to be a laptop as I already have a powerful PC.

As part of the initial research, I thought I might go with a Windows laptop but that was when my old MacBook was working. I thought about MacBook but figured it may be too expensive. However, now that it died, that changes the situation, and it meant I pretty much exclusively needed to look at Mac.

- Since I'm going portable, that means it's a MacBook Pro or MacBook Air.

- Since we have a minimum of 1TB/16GB of RAM, that throws out Air.

Now we can ask the question: what are all possible MacBook Pro configurations that satisfy this criteria?

Obviously, I didn't want one from 2011 – that makes no sense. But I also wasn't sure if I wanted the latest M4. Is it really that much of a difference?

Before M-series silicon, MacBooks used Intel chipsets. From the research I did, I knew that I probably wanted the M-series chipsets because they represented a massive leap in performance.

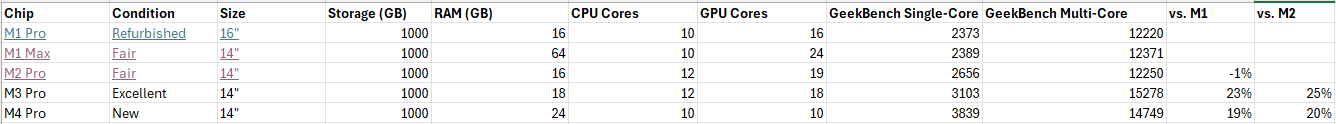

Since the M-series is the latest gen of MacBook, I decided I'd stack the versions against each other to compare.

Make a spreadsheet

I laid out the core specs I cared about in a spreadsheet, then checked each Apple M generation chip for benchmarks. I wanted to see what value the M4 brings to the table vs. the other chips.

The M-series usually has two variants: Pro and Max. The Max is the top-of-the-line trim which usually supports higher specs.

Here's what I came up with:

Notice how my columns reflect what I value the most. I was OK with a 16" screen but actually preferred the 14" since I'm used to an ultrabook (and it ends up nearly always being cheaper anyway).

For the M1, in order to exceed 16GB of RAM, I also had to look at the M1 Max, which turns out to be pretty important as you'll see in a second.

We are almost to the min-maxing phase, but we're missing what we want to minimize: price.

Figure out your budget

What are you willing to spend? I can't answer that for you. I find it helpful to define a ceiling for myself.

I won't spend more than $2,000 on a new laptop.

And sometimes, a floor can be useful:

I don't want anything less than a $600 laptop because it's junk.

I'd be careful with floors because you'll be surprised how often you'll find a premium product for a low price. But they can make sense especially when price dictates quality; like when I was shopping for HVAC contractors. I would advise going with the lowest bid for anything you work on in your home.

Employ price shopping strategies

There are so many tactics here but I'll share the overall strategies:

- Buy used/refurb instead of new

- Discount initial price with coupons/promos

- Credit purchase with credit card rewards points

- Check for credit card bonus offers

- Check employee discounts

- Check price history

- Buy through rewards portals

I'll share how I employed some of these strategies.

Seasonal and membership discounts

Since it's around Black Friday, it made sense to check out local retailers for doorbuster deals. Best Buy also offers Geek Squad refurbished items. I'm a Costco member, so it made sense to check there too.

I also got turned onto Backmarket from a repair shop YouTube channel. Shops repair and certify refurb tech and resell it on Backmarket. There are some nice perks you get above Facebook Marketplace or Craigslist:

- Sold by actual shops

- Repair or replacement if it doesn't work within a year

- Option to extend by another year that includes two repairs/replacements and a full refund

- Laptops must have at least 85% battery life left

Finally, since my wife is an educator, I checked out Apple's educator discount: not much it turns out ($100 off) 👎.

Checking rewards points and bonus offers

For my credit card rewards, my Chase Ink Business card had $106 I could use to refund a purchase (that's a 1X refund, but Chase points are worth 25% more if used for travel).

Chase also had an offer where points were worth the 25% extra if used to buy Apple products. This means, instead of buying from Best Buy brand new, it would make more sense to buy straight from Apple through the Chase rewards portal.

Aaron Hurd came to Minnedemo this year and he has good advice on his site CardsAndPoints.com if you need a list of cards for welcome bonuses or specific retail shopping (like Amazon, Walmart, or Target).

Choosing the shop(s)

The shops you end up going with may be influenced by your urgency (need it today vs. can wait a week), your affiliations, or your values (I don't buy on Amazon if there's an alternative, even if it's more expensive).

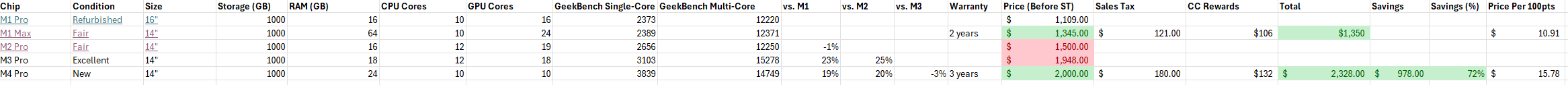

After some browsing around, I quickly decided that if I bought new, I'd use my Chase business rewards portal, and if I bought refurbished, I'd go with Backmarket – Costco and Best Buy didn't have deals for the specs I wanted.

With the price sites picked out, it's time to figure out which configurations are in stock, what the specs are, and how much you'll expect to pay.

Min-maxing specs

If you want to save money, you will trade off with something else. Convenience. Efficiency. Quality. Luxury. The exercise you did upfront in deciding what to compromise on will lead to what you naturally value.

For this strategy, think of RPGs. Are you a min-maxer? I kind of am and kind of not. I look for the value, the Goldilocks zone. I don't want to spend so much time tweaking 1% values. I look for the 20-80% wins, and then don't sweat the small stuff.

A $10 savings is not going to do much, but $500? That's significant. Stick to the Pareto principle.

Now that we have the specs laid out (which we want to maximize), and where to find the prices (which we want to minimize), we can spend some time to min-max and find that sweet spot.

In the end, I narrowed it down to several specific in-stock configurations:

There are plenty of things to talk about here:

Figure out the unit price

When I bought my home, I paid about $150/sqft. I used price per square foot as the measuring stick to compare other homes. This is a unit price and it applies in pretty much any shopping context.

The lowest unit price doesn't automatically mean it's the best decision – notice how I didn't highlight the cheapest option (the M1 Pro) at all. When I compare 16GB of RAM to 64GB of RAM (and the slightly higher score), the higher RAM wins out against the lower price and the 16" loses against the 14" in my book.

But it does provide a nice reference value to compare – is this option in the ballpark, or is it a poor deal?

Compare actual performance

It's not like I plotted each home we went to and noted down energy efficiency ratings to compare against (although I would if it were important to my decision). But some purchasing decisions have clear measures of performance – like CPU benchmarks.

What I wanted to know was: how much better is each successive M-series chip?

You see my columns for "vs. M1", "vs. M2" etc. that I filled in.

Sometimes you'll be surprised by the results, like that the difference between a previous-gen M3 Pro and the current M4 Pro is really low. To me, it made no sense to buy a refurb M3 MacBook when I could buy a brand new one factory-sealed for essentially the same price (and with more RAM). That took the M3 out of the running for me.

Similarly, I was surprised at how much value the M1 Max was compared to the M4:

- A 20% performance differential is a lot, but was it worth the extra $1000?

- The M1 Max had 2.5x the amount of RAM, which usually translates to massive premiums for MacBooks.

- The M1 Max and M4 Pro have the same amount of CPU cores, but the M1 has twice as much GPU cores.

- The M1 Max has retina display of 3024x1964

Couple these with some facts:

- You can't expand RAM on a M-series MacBook

- You can always expand storage externally

- MacBooks are built to last

- The latest MacOS Sequoia is compatible with the M1

In my mind, there's absolutely no question here – the M1 Max was a clear winner in terms of value on the dollar.

Include discounts, rewards, and taxes

I added everything to my cart to calculate sales tax and I used the aforementioned rewards points or took discounts into account.

In fact, after I did a coupon search, I got an additional $25 off the order. 🎉

All these need to be added to understand the total picture.

Consider the downsides and risk mitigation

That's not to say I didn't consider the downsides to getting the M1 Max:

- It's the earliest of the M-series generation, so it will be the first to not be compatible with a later MacOS version

- I'm buying it in Fair condition so it may not look pretty

- I'm buying it refurbished, so it already has a past life

- It won't be serviced under AppleCare

But I can mitigate these risks:

- I'm comfortable with DIY repair. If it comes down to using OpenCore Patcher again I know I can do it.

- BackMarket offers a 1-year warranty but it can be extended another year with full refund support.

- I actually would prefer to recycle and breathe new life into old hardware vs. giving Apple money directly.

So you see, sometimes a downside for one person is actually an upside.

When I did my HVAC purchase, I projected equipment maintenance cost and potential efficiency savings on my electric bills for 5Y, 10Y and 15Y timelines. This made sure I researched which contractor provided the best long-term warranty coverage (which also tells you how much they'll stand by their own work).

Don't wait too long

The whole point of having this clear strategy is to make decisions quickly and not get stuck in analysis paralysis.

I started looking at MacBooks at 9am and purchased the M1 Max at 10:41am.

Now granted, I've used these strategies a lot in the past, so I kinda have a feel for it but each decision is unique. I took about 2 weeks to research and finally find a contractor for my HVAC. It took us a month or so to buy our house (in a buyer's market).

But, if the potential upside is huge, spend the time you need. It takes months of planning and prepping for our big international trips where we save $1000's.

What you don't want to do is take so long that you end up missing out on a good value. Who knows how long that M1 Max would have stayed in stock on a refurb marketplace – my guess is not that long. Then again, HVAC contractors aren't going anywhere anytime soon.

Like in most things, there's some kind of Goldilocks zone. One rule of thumb that can be helpful is the "72-hour rule." I first heard it from Jillian Johnsrud but it's pretty simple: wait 72 hours before hitting that buy button. By the end of that 72 hours, if you still feel like you need the thing, buy it. But many times, you'll find you don't actually need it (or in my case, completely forget about it).

The skill of spending is about being intentional

I bought an "old" MacBook simply because it ended up being more value for the amount of money I was willing to spend and I figured it would last me another 10 years. (Also, it ain't that old.)

All of this is just about being intentional.

There are many forces at work that want you to spend money:

- Social pressure and status

- Time urgency

- Marketing

- Fear (perceived or real) and anxiety

- Stress

- Late stage capitalism

Most of that is outside your control – you can't exactly stop yourself from being on the receiving end of this sexy-ass M4 marketing page.

But you do retain control over your spending – you get to decide, before you hit the buy button, whether this is something you need and whether this is the price you pay for it.

Like any skill, it can be honed

I may have started out using a process similar to this when I was building custom PCs when I was 12 – but it's been refined over the years and a lot of the strategies like rewards points were only added in the last few years. It's ever-evolving and it's not like you stop spending (not for long, anyway!).

Wherever you are, whether you're an impulse buyer, or take forever to make decisions, there's always room to improve your spending skills.

The best place to start I think is by refining your approach to big purchases – home, transportation, food. Once you nail that down, you will automatically start applying these strategies in smaller ways to daily purchases.

I share this slide in my talk because after getting intentional, it made a massive impact on my finances – leading to hundreds of thousands of dollars saved in the long-term:

All of this adds up – because when you save that money, it gives it a chance to be invested and grow. In case you need a framework for that, I've got you covered: